Understand why your forecast has changed and spot risks in the forecast

Inspect your forecasts and see why it has changed

Here's how:

1. Start by understanding how the forecast has changed

The question of why the forecast has changed from one period to the next commonly conjures a feeling of dread for leaders and managers. Sometimes it’s tough to explain why; other times, it’s because you don’t know, leading to a dull trawl through the CRM.

To simplify understanding the ‘why,’ we begin by looking at Forecast Change. Here we can see how your commit or best case (or whichever terminology you use) submissions are changing.

First, we slice and dice our forecast to isolate what interests us: by team, seller, product, revenue type, etc.

The waterfall graph then updates how your forecast has changed from one period to the next. From here, we can understand why it has changed in several different ways:

- What deals have slipped? (we know win rates drop by 47% when they do)

- What deals have been pulled in from future pipeline? (therefore, do we have sufficient coverage next quarter?)

- What deals have been forecast out? (are my sellers under-confident of what they can close?)

- What deals have been forecast in? (how likely are these to close now they have been added? Are reps being over-confident?)

- What deals have been added from previous quarters? (Why are we now confident these deals will close?)

- What deals have decreased/increased in value? (Are sellers being under/over-confident?)

Once we’ve identified where we want to investigate further, we can then inspect the individual opportunities to understand why the forecast has changed.

2. Inspect why the forecast has changed

Understanding why a forecast has changed can confuse and frustrate any leader or manager.

Typically, this requires digging through spreadsheets, the CRM, and speaking to reps to try and understand.

To spare the frustration and to give more insight than a conversation can offer, we created Pipeline Insights. Here we can use all the same filters as step one to deeply inspect every deal in the changed forecast.

What we look at will depend on what part of the forecast we want to understand. So, for example, let’s say we want to inspect why so many deals have slipped:

- Do we need more engagement with the buying committee? (we measure the trend with our Relationship Score)

- How likely is this deal to close? (we base this on your similar closed deals with our Deal Score)

- Is this deal at risk of being lost, or can it be closed? (we benchmark the performance of this deal against similar previous ones to show Positive and Negative Factors)

- Is there a clear next step to get this deal closed? (we sync this with your CRM)

- Is the deal still on course to close based on the qualification criteria? (this we sync with your CRM too)

- Is there recent activity, and what is it? (we capture every e-mail, call, and meeting, which you can review together)

So instead of jumping in and out of spreadsheets and scraping the CRM, it’s now possible to understand why the forecast has changed, equipping you with context to carry into your next meeting.

3. Identify risk in your forecast

When submitting their forecast, the challenge for sales leaders and their managers is trusting the number submitted to them. With every forecast, we rely on the instinct of our sellers and often find ourselves having to justify their decisions. This inevitably leads to headaches and disagreements because we base forecast calls commonly on gut feeling.

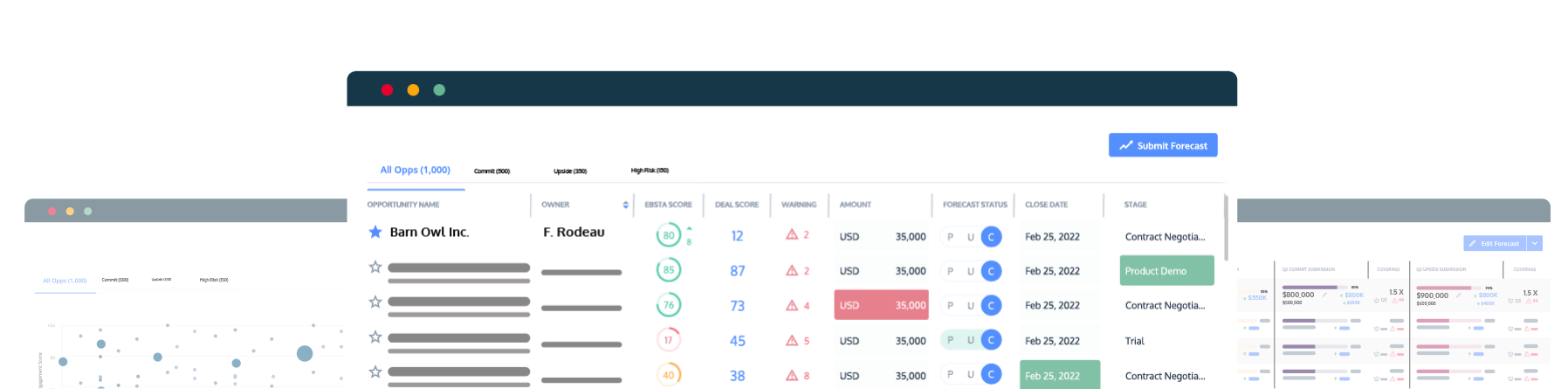

To avoid those difficult conversations with your boss or rep, we can use the Opportunity Table to inspect our team’s forecasted deals. Not only does this enable us to challenge our sellers on their calls (using evidence), but it also allows us to have confidence in the number we submit.

We can inspect the forecast and identify risks using a similar cadence as above before submitting our number. So, for example, if we are looking at committed deals:

- Is engagement still strong and trending positively? (we measure the trend with our Relationship Score)

- Is this deal on a similar track to close as similar previous deals? (we base this on your similar closed deals with our Deal Score)

- Are there any potential risks we need to be aware of? (we benchmark the performance of this deal against similar previous ones to show Positive and Negative Factors)

- Do we have a clear next step to close the deal on time? (we sync this with your CRM)

- Is this deal still meeting the qualification criteria? (this we sync with your CRM too)

- Do we have future activity booked to close this deal? (we capture every e-mail, call, and meeting, which you can review together)

Now when it comes to leaders and reps calling their number, we can confidently make that call. In addition, we can also spot risk in the pipeline early before it gets committed to the forecast.

4. Call your forecast with confidence

Forecasting is notoriously difficult to predict because so many variables are out of our control. As a result, this leaves sellers often relying on their gut to make those calls. Sometimes that’s correct; often, it is not. Inconsistent decision-making becomes a compounding issue for the rest of the business as confidence over how many dollars will be available to invest next quarter wanes.

To improve confidence in the sellers’ forecast (leading to more accurate forecasts), we support sellers with insights to back their calls through the Opportunity Table.

When using Ebsta, reps can toggle their forecast as the quarter progresses. Below is a cadence reps’ follow to submit their commit forecast:

- What deals are in a late pipeline stage and are likely to close?

- How likely is the deal to close based on my similar previous deals? (we base this on your similar closed deals with our Deal Score)

- Do I still have strong, positive engagement with the buying committee? (we measure the trend with our Relationship Score)

- Am I confident in my next step to get the deal closed? (we sync this with your CRM)

- Is the deal still on track based on when I qualified the deal? (this we sync with your CRM too)

- Are there any risks of this deal slipping that I must address now? (paperwork, legal teams, losing momentum, etc.)

- Update the toggles, then hit submit forecast

Our gut calls are sometimes reliable, but this extra validation goes a long way to increasing confidence in the forecast and spotting potential risks early.