Share this article

Learn from the brightest minds how to predictably and efficiently grow revenue.

Related Content

5 Ways to Use the Ebsta Integration With HubSpot to Improve Sales Performance

How to improve adoption of HubSpot with Ebsta

B2B Sales Benchmarks: 2023 H1 Update

The latest update from the 2023 B2B Sales Benchmarks analysis of over $37bn in pipeline.

How to improve AE quota attainment (according to data)

23% of reps are contributing 83% of revenue. Here's how to solve it (with data)

The Ultimate Guide To Sales Pipeline Management Best Practices

What is Pipeline Management?

Sales Pipeline Management is about effectively tracking opportunities from start to finish, all the way through to when they are closed won, or lost.

Why is Pipeline Management important?

- Identify deals at risk and be proactive in salvaging them

- Establish which deals to prioritize so you can close deals faster

- Stay on top of your pipeline in real-time

- Reduce deal slippage

- Ensure you have enough pipeline for reps to ensure they hit quota

- More accurate data reporting allows you to make better decisions

- Leverage data to improve processes to close more deals faster

In this blog we take a look at how you can improve these pipeline management processes:

- Building Pipeline

- Metrics To Track

- 1:1 Pipeline Reviews

- Forecast Call

- QBR

- Current Quarter Pipeline Review

- Top Deals Review

- Next Quarter Pipeline Review

- Next Quarter Commit

Sales Pipeline Management Best Practices

Building Pipeline

- Defining what your sales pipeline looks like

Clearly defining your sales stages provides a framework for your sales reps so they know exactly what needs to be done to get their deals over the line.

It helps both sales reps and managers to understand how every prospect is moving through their pipeline.

Below is a diagram of the 7 stages of the sales cycle that we recommend considering to increase your pipeline visibility.

- Take a look at historical data

You need to understand how opportunities move through your pipeline. Understanding historic data can be useful for two reasons:

- Allows you to benchmark success and failures

- Use this information to tweak and optimize your sales process so your sales reps can close more deals faster

- Benchmark

Benchmarking success will allow you to identify the characteristics of customers who are more likely to close.

So, when you evaluate your opportunities in 1:1 pipeline reviews, for example, you can see which deals need to be prioritized.

On the opposite side of this, if you are aware of where and when you usually lose opportunities, you can more easily identify when an opportunity is at risk and be proactive in salvaging it.

- Cater to your ICP

An ideal customer profile is a description of businesses that will experience the most value from your product or solution.

As mentioned in the benchmarking section, you will begin to notice common traits in opportunities that you have closed successfully.

By going after companies with similar traits, you are more likely to target qualified pipeline. These are accounts that have a genuine need for your product or service.

- Build the RIGHT relationships with the RIGHT people

High-performing companies prioritize engagement with key personas and this is what sets them apart from low-performing ones. Well, who should you be connecting with?

The MEDDPICC® framework helps to identify two key personas – the economic buyer and champion.

Economic buyers and champions usually have the same titles across companies so analyzing historic data (step 2) will give you the keys to unlock key personas you should be engaging with.

- Keep your pipeline healthy

Now your pipeline should be up and running!

However, it can get dirty very quickly if you do not update your CRM.

54% of B2B businesses say poor quality data is their biggest challenge – ZoomInfo

There are 4 dirty data types that can corrupt your CRM resulting in lost deals, longer sales cycles, incorrect business decisions being made and a poor customer experience.

Learn how you can keep your CRM squeaky clean here.

Metrics To Track

Measuring the right metrics is the key to understanding and managing deals on an individual level at every stage of the sales process.

It equips you with a high level of visibility so you can identify issues before they occur and action them accordingly.

Here are the 7 metrics we recommend tracking to get the most out of your pipeline:

- Sales velocity

- Win rate

- Sales cycle length

- Average deal value

- Number of opportunities

- Relationships and engagement

To learn more about how to calculate these metrics and why these metrics are so powerful download this cheat sheet

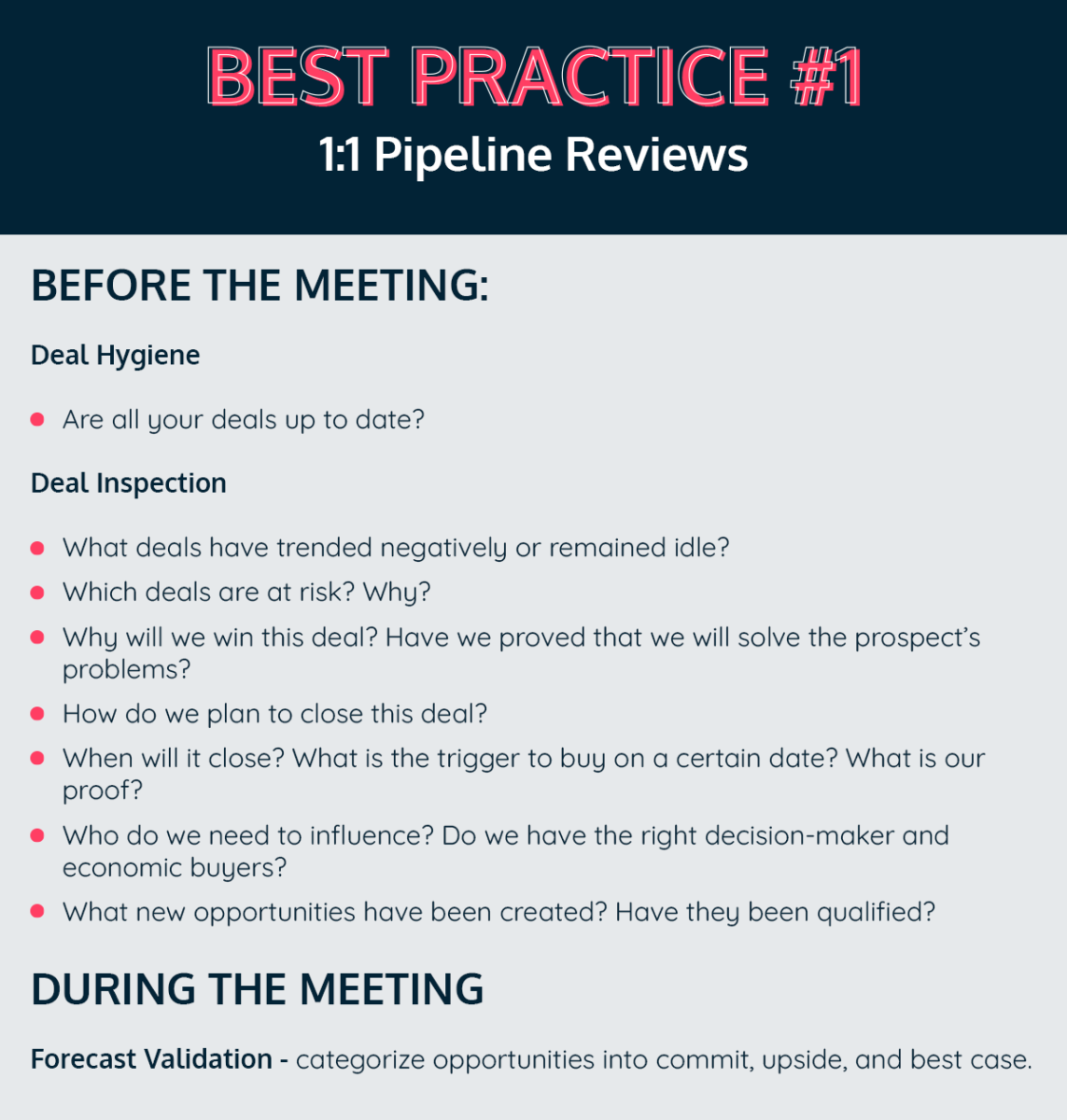

Best Practice #1 – 1:1 Pipeline Review

A 1:1 pipeline review is an essential strategic meeting that is the foundation for all other meetings.

What I mean by foundation, is that your forecast call is a continuation of your 1:1 pipeline review so if there are inaccuracies at this level, they will trickle down to your overall forecast.

This is true for every meeting from here on out.

The purpose of pipeline reviews is for sales reps and managers to inspect each opportunity and review them.

It gives sales reps a chance to discuss any issues they may be having and managers a chance to offer support, additional resources and coaching.

This is how pipeline reviews are structured:

They cover 3 key aspects to ensure your pipeline is up to date – Deal Hygiene, Deal Inspection, Forecast Validation.

BEFORE the pipeline review both managers and sales reps should evaluate the deal hygiene and deal inspection sections to prepare for the meeting.

DURING the pipeline review managers and sales reps should go through forecast validation.

BEFORE THE MEETING

Deal Hygiene

- Are all your deals up to date?

Go through every opportunity and ensure they are updated with the correct information such as the stage, amount, and close date in your CRM.

This should be done daily to ensure you are on top of your opportunities and your CRM reflects your opportunities in real-time.

This is especially valuable as it saves time in your pipeline reviews.

Instead of catching up on the state of play of your pipeline, both reps and managers have access to this information beforehand.

Deal Inspection – deep dive into every opportunity with these questions:

- What deals have trended negatively or remained idle?

Engagement can make or break your deal. If a deal has not progressed or regressed, you need to engage with them ASAP.

The people you engage with are decision-makers and neglecting them reduces the likelihood of closing the deal.

- Which deals are at risk? Why?

Identifying opportunities at risk early increases the likelihood of salvaging those deals as you can push your sales reps back onto the right track.

- Why will we win this deal? Have we proved that we will solve the prospect’s problems?

The MEDDPICC® framework gives you all the information you need to understand what criteria needs to be met to close a deal. If there are important areas that have been neglected, they should be actioned with urgency.

- How do we plan to close this deal?

At every sales stage, you should have a next step outlined.

Clearly defining each sales stage and what needs to be done to progress to the next stage helps both reps and managers understand next steps.

- When will it close? What is the trigger to buy on a certain date? What is our proof?

Do you have an understanding of all the factors affecting your opportunity? For example, the level of engagement with stakeholders, activity on the account, and time in stage.

These factors indicate if you are on track to close your deals and if these factors are negative, these opportunities will require urgent attention.

- Who do we need to influence? Do we have the right decision-maker and economic buyers?

It can be tricky to be 100% certain to know if you are nurturing the right person. Find a list of all the requirements needed to qualify a champion and economic buyer here.

- What new opportunities have been created? Have they been qualified?

New opportunities need to be qualified as this plays a big role in prioritizing opportunities for sales reps. Ensure you are not missing any steps with our Deal Qualification Guide.

These questions ensure no stone is left unturned and gives you the ability to keep deals on track to close, save deals from slipping, and help you to plan next steps.

DURING THE MEETING

Forecast Validation – categorize opportunities into commit, upside, and best case.

With all of the data from deal hygiene and deal inspection, you can review all of your opportunities and make an informed decision on where they stand.

Having these conversations creates alignment between sales leaders and reps and squashes any discrepancies that could occur.

Best Practice #2 – Forecast Call

A forecast call is a continuation of your 1:1 pipeline review.

In this meeting, you review your current quarter pipeline progression and the “commit” forecast.

It gives you a chance to ensure that all forecast submissions are based on hard data rather than gut feeling.

Relying on data results in a more accurate forecast which is the ultimate goal.

This is how forecast calls are structured:

- How much have we closed so far?

Understanding how many deals you have closed allows you to assess if you are on track to meet your targets.

Inspect the number of opportunities won, amount of deals, and the percentage of how many deals are won out of your pipeline.

- Is that on pace with our target?

You want to understand how you are performing relative to your quota so you can outline the next steps to stay on track.

- What is the Manager’s commit?

These are the deals, from a manager’s perspective, that can be safely expected to close this quarter.

- Why is that ahead or behind the Rep’s commit?

Discrepancies can result in inaccurate forecasts. Ideally, managers and reps should be on the same page and this is a chance to squash any discrepancies.

- Is there a big difference between the commit and upside?

If there is a difference between the amount that is most likely to close and deals that we are optimistically hoping to close, then this is a potential issue.

If there are large discrepancies, this meeting is a chance to understand the reasons for this and plan your next steps.

- What specific deals are in the commit and upside?

Having an idea of which deals are in commit and upside can help you to plan for the future.

This meeting’s structure introduces a clear and concise system of record, creates visibility to make data-driven and accurate forecasts as well as be proactive in hitting your targets.

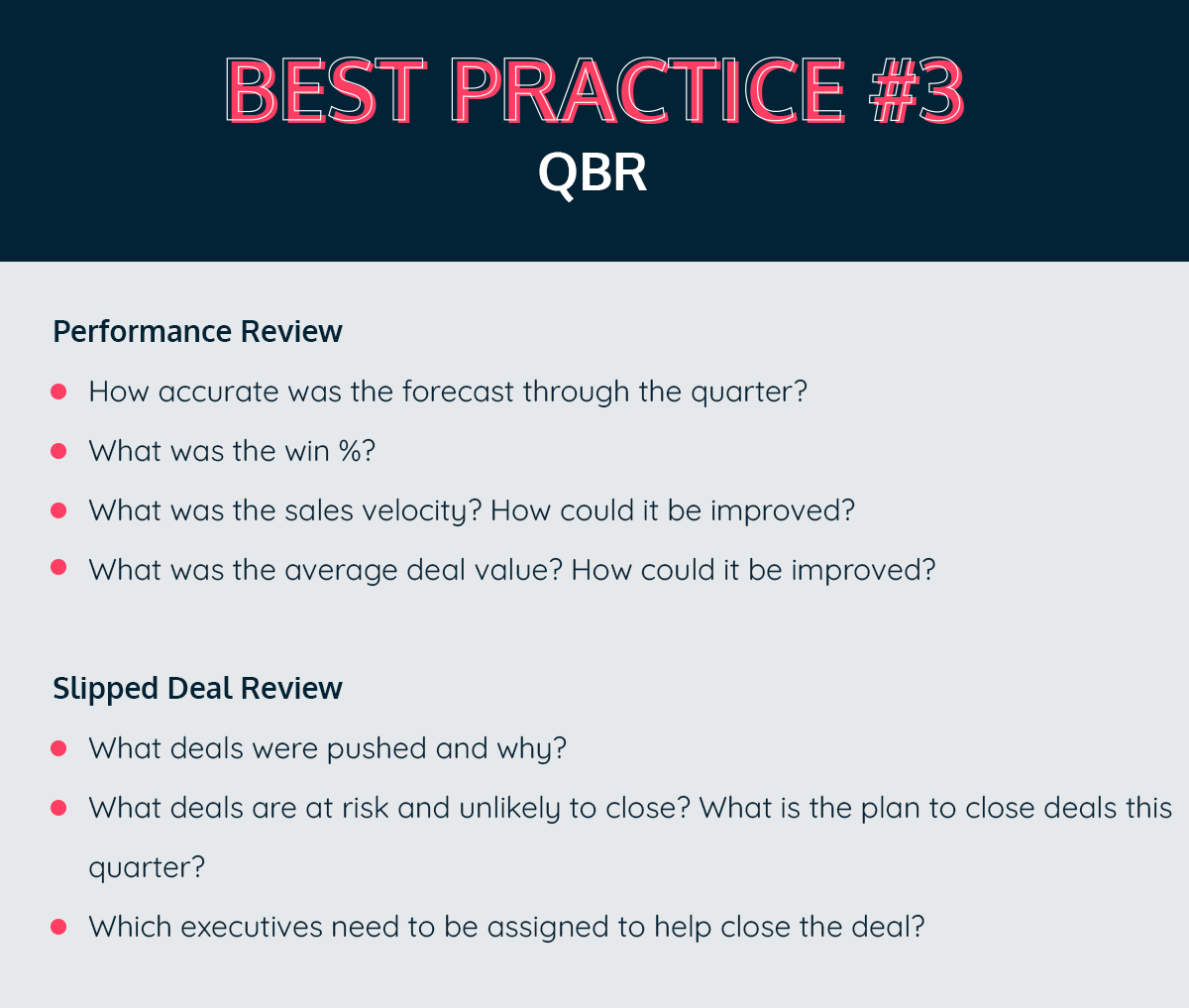

Best Practice #3 – QBR

Quarterly Business Reviews are a more high-level overview of performance.

Whereas, pipeline reviews and forecast calls dive into the specifics of each opportunity.

So in these reviews, you want to be looking at any trends emerging and if you are progressing towards your quota.

Slipped deals are one of the biggest blockers that prevent sales teams from hitting quota so naturally, they are a big part of a QBR.

This is how QBRs are structured:

QBRs can be split into two parts – Performance Reviews and Slipped Deal Reviews.

Performance Review

- How accurate was the forecast through the quarter?

It is important to ensure your processes are effective. If your forecast was not accurate, where did these discrepancies originate from?

This can be found by looking at the value of the revenue brought in and comparing it to the forecast you have submitted.

Understanding this can help you to prevent the same mistakes from happening in the future.

- What was the win %?

Are you getting the most out of the opportunities in your pipeline?

If not, you may have issues with qualifying your opportunities. Or, there might be a certain sales stage where deals are slipping.

This can help you identify the cracks in your pipeline and ensure the same mistakes are not made again.

Covering up these cracks can result in a large number of deals progressing to the next stage and eventually closing successfully. Small fixes that result in improvements that compound is known as marginal gains.

- What was the sales velocity? How could it be improved?

Sales velocity = Opportunities x Win Rate x Average Deal Value / Sales Cycle

This is the speed at which deals are progressing through your pipeline. Understanding the pace at which they move through each stage can help you to refine your processes.

How?

You can see where deals are progressing quickest and identify the areas where they are being lost or lagging behind.

This allows you to deep dive into where things might be going wrong and identify the root cause of why deals are being lost or slipping.

For example, if deals are progressing well until negotiations then your sales reps might need to adjust their negotiation approach.

- What was the average deal value? How could it be improved?

Average deal value = Revenue generated from closed-won deals/Number of closed-won deals

This is a key indicator of how much time and effort you should be spending on an opportunity.

If the deal value is looking small, there may be an opportunity to upsell or even cross-sell.

Slipped Deal Review

- What deals were pushed and why?

You can identify reasons for deal slippage and can plan for the future to ensure the same mistakes are not made again.

- What deals are at risk and unlikely to close? What is the plan to close deals this quarter?

Identifying the problem allows you to find solutions. You can outline the next steps to steer the opportunity in the right direction.

The MEDDPICC® framework acts as a checklist for sales reps to see what needs to be done to get a deal over the line.

If a deal is MEDDPICC® qualified, it should be a high priority as this prospect has a need for your product or is ready to buy.

High intent should be a high priority as these are the deals most likely to close.

- Which executives need to be assigned to help close the deal?

Some deals might need a final push to get them over the line and sales leaders can appoint the most qualified person to complete the deal.

Every sales rep will have their own strengths and weaknesses.

For example, if one of your reps is struggling with prospecting but is an excellent closer and one of your reps struggles with closing and is an excellent prospector then these reps could work interchangeably on deals together.

This QBR structure creates visibility of the past and present of your pipeline and creates a shift towards a single source of truth across the business.

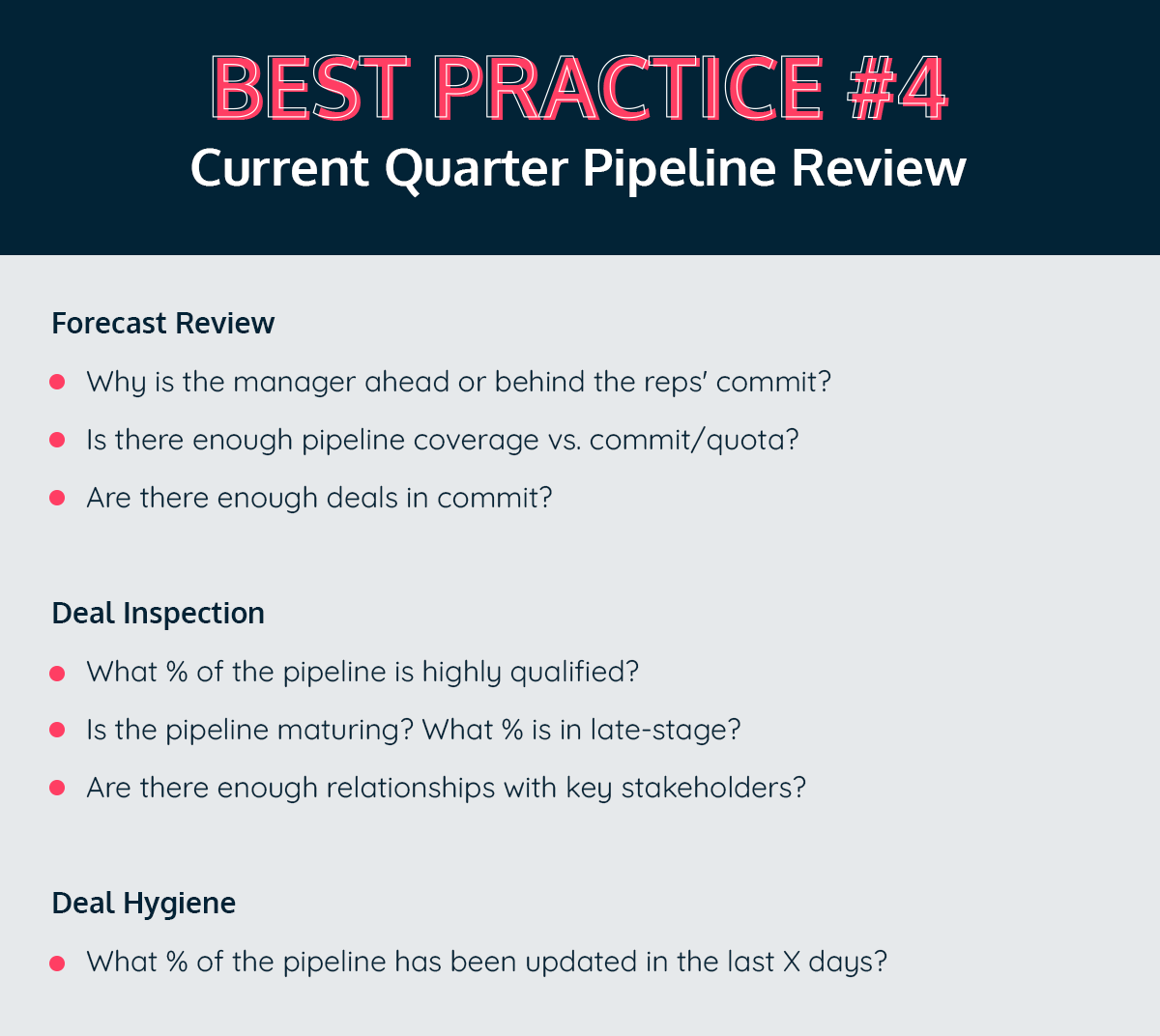

Best Practice #4 – Current Quarter Pipeline Review

The purpose of this meeting is to understand if you have enough pipeline coverage to meet quota.

Pipeline coverage is the sum of all your sales opportunities compared with your revenue target.

Pipeline coverage is also based on the reps average win rate too.

So if they have a target of £100,000, and they have an average win rate of 25%, it’s fairly straightforward that if you give them £400,000 worth of pipeline, then there is enough pipeline coverage for them to hit their target.

Essentially, you are asking if you have enough pipeline to meet your target.

This allows you to ensure you are on the right track and you do this by reviewing deals in the current quarter.

If there is pipeline at risk, there is still time to salvage these opportunities by providing reps with more support, coaching, or resources.

This is how current quarter pipeline reviews are structured:

Forecast Review

- Why is the manager ahead or behind the reps’ commit?

In an ideal world, the value of your manager’s commit and your reps’ commit should be the same. By the end of this meeting, you should reach an agreement on the true value of the commit.

- Is there enough pipeline coverage vs. commit/quota?

This allows you to stay prepared ahead of time and indicates whether you need more pipeline to hit your target.

- Are there enough deals in commit?

This keeps you on track to meet your quota. See your open pipeline coverage and what it needs to ensure you hit your targets.

If deals are not in commit, why not? Dive into the specifics of how you can accelerate these deals to a close this quarter.

Deal Inspection

- What % of the pipeline is highly qualified?

Easily identify qualified pipeline with MEDDPICC® .

With the MEDDPICC® criteria, you can identify the next steps accordingly. For example, are you engaged with the champion and economic buyer?

The MEDDPICC® framework acts as a checklist for sales reps to see what needs to be done to get a deal over the line.

If a deal is MEDDPICC® qualified, it should be a high priority as this prospect has a need for your product or is ready to buy.

High intent should be a high priority as these are the deals most likely to close.

- Is the pipeline maturing? What % is in late-stage?

As the quarter progresses, so should your pipeline.

If an opportunity is stuck in a stage too long, this is a red flag and you need to be proactive to get this opportunity moving again.

- Are there enough relationships with key stakeholders?

This is one of the keys to pushing deals forward. The optimal number of relationships resulting in closed-won deals is 7 to 9 relationships.

There is a positive correlation between the number of relationships and win rates meaning the more relationships you nurture, the more likely you are to close a deal successfully.

The MEDDPICC® framework can help you to identify these key stakeholders to increase your chances of closing more deals successfully.

Deal Hygiene

- What % of the pipeline has been updated in the last X days?

Idle opportunities are at risk of slipping.

Identifying opportunities with poor or no engagement highlights the opportunities that need attention ASAP so they can be salvaged.

This structure allows you to identify opportunities that may be at risk and ensures that your pipeline is healthy.

Best Practice #5 – Top Deals Review

The purpose of top deals review is to inspect the tools in the current quarter to review closing plans.

How?

Following the 8 criteria of the MEDDPICC® framework can help you to ensure that deals are fully qualified and you have covered all your bases.

For example, people often leave red tape with legal teams to the last minute of a deal closing. MEDDPICC® helps you to stay on top of this and sets this into motion early on during the sales process to avoid delays later on.

This is how top deal review meetings are structured:

Deal Hygiene

- How are the current top deals trending?

You want to prioritize top deals so by understanding how they are trending you can identify the next steps for sales reps.

Are they idle, trending up, trending down, slipped, lost, or won?

This is valuable because top deals trending negatively will be flagged and your team still has a chance to rectify these deals back onto the right track.

- What top deals are at risk? Why?

These are the deals that you really want to win and so if they are at risk, you want to do everything you can to prevent these deals from being lost or slipping.

By analyzing your historic data, you can spot common trends of where deals are usually lost.

For example, if your sales reps are not handling objections well after an offer is presented time and time again, you may want to tweak and adjust your objection handling strategy.

Deal Inspection

- Have all stakeholders been recorded in your CRM?

Do you have an understanding of all the relationships within an account? From sales reps and decision-makers to buyers, you should have a record of all the contacts within an account as well as the level of engagement with each contact.

Relationship mapping can be an incredibly powerful tool to keep on top of engagement and relationships.

If you are not engaged with a key decision-maker who has a final say over if the product or service is bought, then consider all of the time and resources you have spent on this opportunity a waste. Relationships can make or break your deal.

- How do we plan to close this deal in this quarter?

You want to have clearly defined next steps for all your deals in commit. This is one way to ensure these deals close this quarter.

- What is the trigger to close the deal in this quarter?

This is the final step a sales rep will take in order to close a deal. Using the MEDDPICC® framework can help you to understand when this trigger should be pulled.

Is there one step from the 8 MEDDPICC criteria that your sales reps have not completed? This is your trigger.

- Which executives need to be assigned to support the deal this quarter?

Some deals may need more attention to close and you want to ensure your reps have covered all bases and have what they need to close the deal.

For example, one of your sales reps might be a strong closer and there might be an opportunity that is close to closing but has a few objections that can be overcome.

You would want this sales rep to handle these objections as this is their strength.

This structure reduces risk by providing visibility of the health of the top deals that quarter as it allows you to outline the next steps.

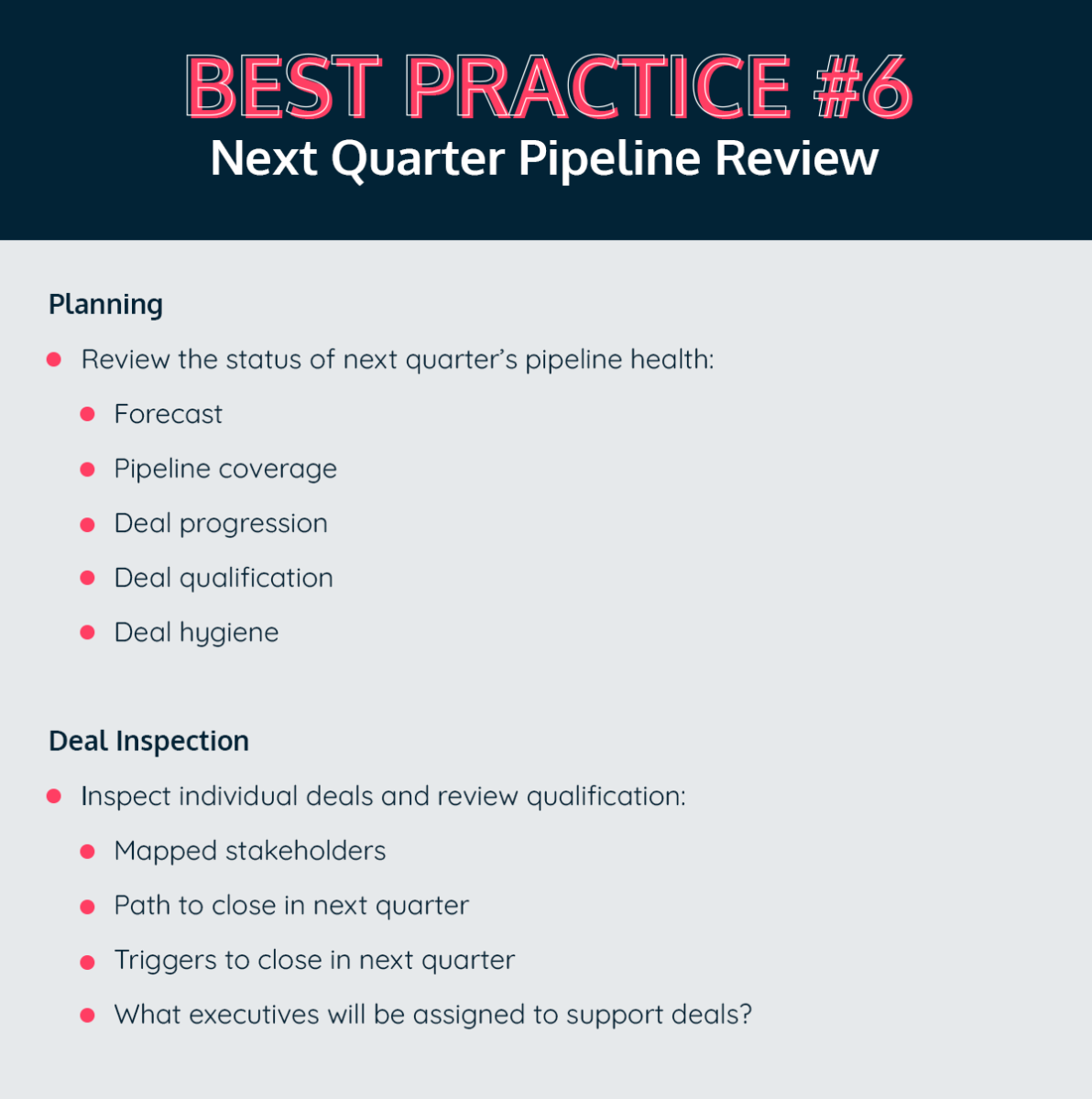

Best Practice #6 – Next Quarter Pipeline Review

The next quarter pipeline review has the same structure as 1:1 pipeline reviews but you are looking at opportunities in the next quarter.

The purpose of this meeting is to stay ahead of steam and be prepared for the upcoming quarter by inspecting deals that may have slipped or new opportunities that your reps will be working on.

This is how next quarter pipeline reviews are structured:

Go through every opportunity and ensure they are updated with the correct information such as the stage, amount, and close date in your CRM.

This structure equips you with an understanding of your pipeline for the next quarter so you can be prepared. If you prepare to fail, fail to prepare!

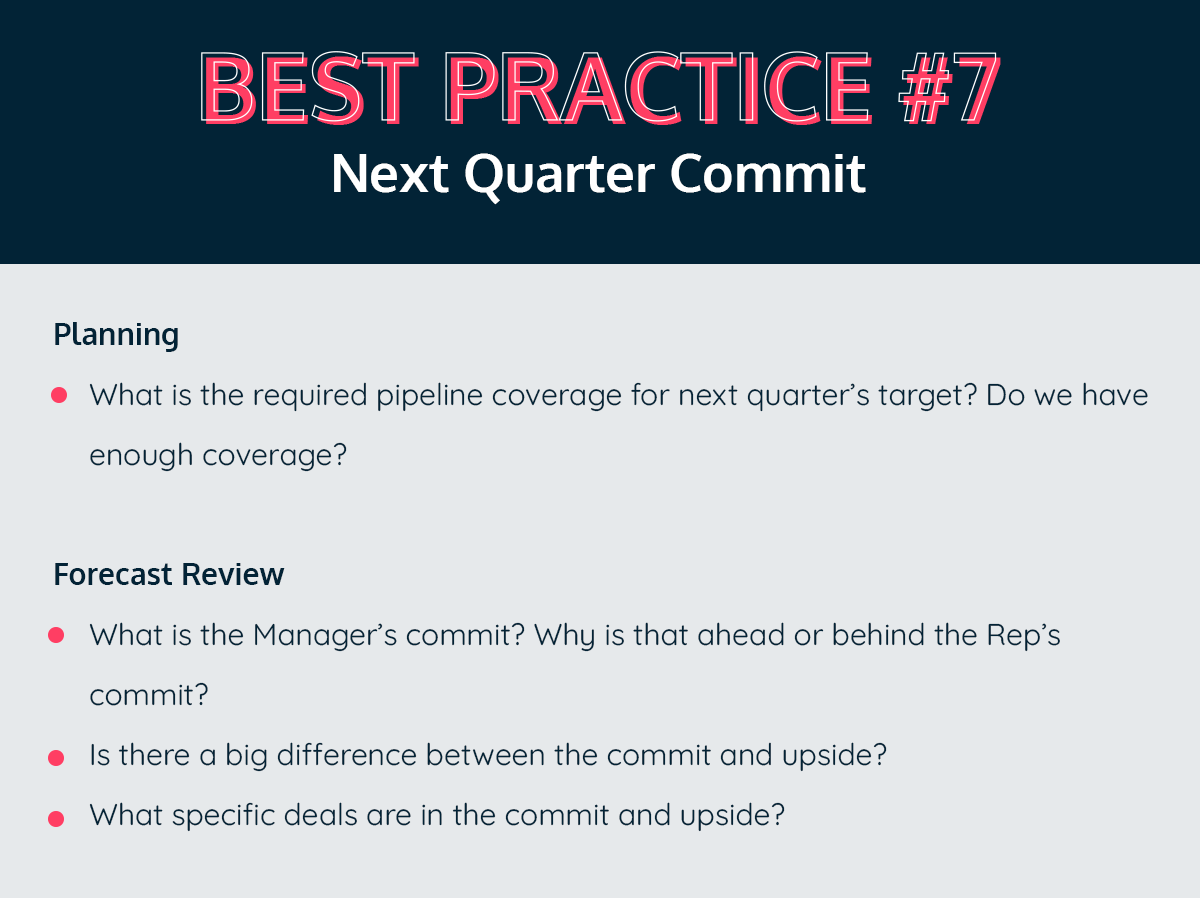

Best Practice #7 – Next Quarter Commit

This meeting has the same structure as the forecast call but you are looking at opportunities in the next quarter.

The purpose of this meeting is to review potential top deals for the upcoming quarter so you can be prepared ahead of time and ensure these deals stay on track to close.

This is how next quarter commit meetings are structured:

Planning

- What is the required pipeline coverage for next quarter’s target? Do we have enough coverage?

This lets you know ahead of time if you need to create more pipeline to meet your target for the next quarter.

If you do not have enough pipeline, then you need to introduce new opportunities into your pipeline. This requires additional time and resources so knowing this information ahead of time can help you to stay prepared.

Forecast Review

- What is the Manager’s commit? Why is that ahead or behind the Rep’s commit?

- Is there a big difference between the commit and upside?

- What specific deals are in the commit and upside?

This structure allows you to check if your pipeline coverage is acceptable and gives you an understanding of all your top deals.

Next Steps

The structures we have introduced in these blogs encourage collaboration, introduce a new level of visibility, and can improve your forecasting accuracy.

Standardizing these essential meetings can move the needle for your business significantly. Learn how you can conduct these meetings effectively and efficiently with Ebsta.

Recommended Resource

Download our forecast cadence e-book to have your own copy of all of the questions from each use-case mentioned above!