Share this article

Learn from the brightest minds how to predictably and efficiently grow revenue.

Related Content

5 Ways to Use the Ebsta Integration With HubSpot to Improve Sales Performance

How to improve adoption of HubSpot with Ebsta

B2B Sales Benchmarks: 2023 H1 Update

The latest update from the 2023 B2B Sales Benchmarks analysis of over $37bn in pipeline.

How to improve AE quota attainment (according to data)

23% of reps are contributing 83% of revenue. Here's how to solve it (with data)

How to implement MEDDPICC into your sales process

MEDDPICC® is a framework for sales teams to qualify prospects. It introduces a standardized process that creates predictability.

Why MEDDPICC®?

A common problem for sales teams is that their pipeline reviews do not have a solid structure.

It varies from week to week.

Let’s take a look at what a generic quarter would look like:

- At the start of the quarter, the focus is on building pipeline. What opportunities do we have? What is the plan of attack?

- As the quarter progresses, the focus is on keeping the momentum going on any open opportunities.

- At the end of the quarter, the focus shifts to accelerating deals to a close to get them over the line. The biggest problem for sales reps at quarter-end is often slippage so this is a critical time for sales teams.

Implementing MEDDPICC® can help you to stay on top of your opportunities, smash your pipeline targets, and improve sales velocity allowing you to then work on more opportunities.

Here is what a quarter with MEDDPICC® would look like:

- At the start of the quarter, both sales reps and managers know what to expect and can focus on discussing the 8 elements of MEDDPICC®. Both parties have a clear idea of what their target is. Reps can focus on identifying who the economic buyer is, who the champion is and what is the decision criteria and process look like.

- As the quarter progresses, managers can assist the rep to stay on track by going through MEDDPICC®. They can ask specific questions. For example, instead of asking do you have the right relationships, a manager would now ask do you have a relationship with the champion and economic buyer. How well engaged are they? What more needs to be done to accelerate progress with the buyer?

- At the end of the quarter, you would be able to pinpoint what needs to be done to ensure deals are not at risk and will close before quarter-end.

- In addition, sales teams can review performance against the MEDDPICC® framework to understand what worked, what did not, and carry those learnings into similar future deals.

Introduce a solid structure to your pipeline reviews today with our guide on every question you should be asking in your pipeline reviews.

Download the guideMEDDPICC® allows your pipeline reviews to be more direct and to the point.

It needs to be diligently reported back on in pipeline reviews to keep reps focused on the factors which matter most.

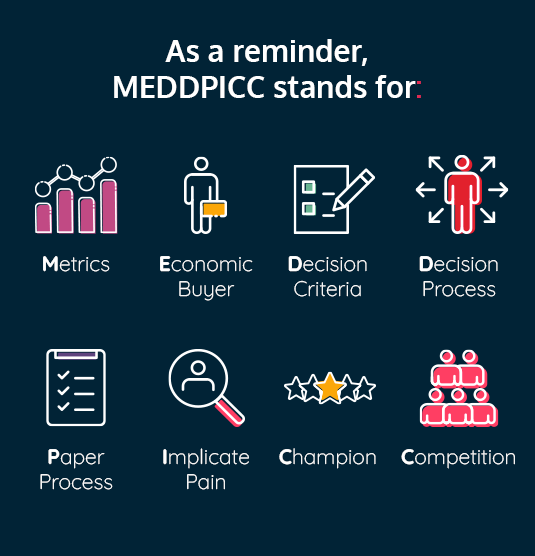

METRICS

Metrics quantify the value your solution can provide.

This section is where metrics meet discovery.

In order to truly understand the prospects’ pain points, you need to go deep in discovery.

This allows you to personalize the pitch to illustrate how your product solves their pain point.

The aim of these questions is to quantify the value of your solution.

Not only this, you will be able to quantify the cost of the pain to their business.

How to introduce METRICS into your pipeline reviews

Introducing metrics into pipeline reviews gives managers visibility of which opportunities to prioritize. Why?

Your product will not be the right fit for every single prospect you reach out to.

By understanding these metrics, you can identify which prospects are ready and compatible with your solution.

- Start:

- At the start of the quarter, managers can dig through all of the opportunities in their pipeline and ensure that their reps have done their due diligence with discovery. Metrics are especially important at this stage as they shape what your pitch will look like and can help you prioritize opportunities.

- Middle:

- As the quarter progresses, you will need to revisit metrics as it is used throughout the MEDDPICC® process. For example, when you are building your champion, your rep will need to revisit these three questions from the perspective of the champion. You will also need to revisit metrics to identify the cost of the pain experienced by the prospect.

- End:

- At the end of the quarter, managers can go through the priority list of opportunities created at the start of the quarter to ensure the deals with more value are on track to close.

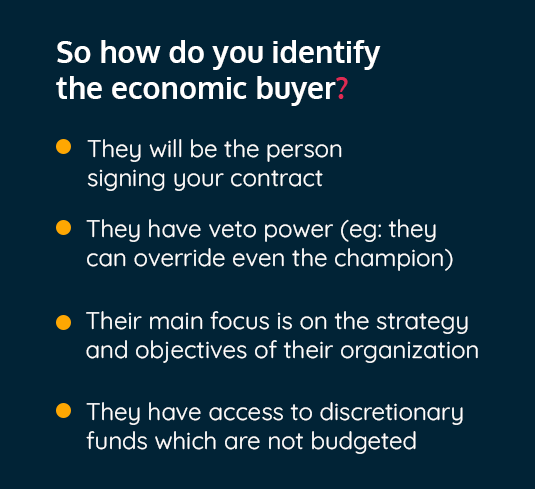

ECONOMIC BUYER

This is the person who has the final say on the business decision.

It can be very easy to over qualify or under qualify an economic buyer.

How to identify the economic buyer in your pipeline reviews

The more engaged you are with the economic buyer, the more likely you are to close a deal.

Alongside your champion, these two stages of MEDDPICC® are the most critical and can make or break your deal.

We previously discussed the beginning, middle, and end of the quarter from a sales manager and rep perspective, so here is how to approach the economic buyer at each of those stages.

- Start:

- At the start of the quarter, you need to identify the economic buyer. Do they meet all the criteria to be an economic buyer? It is incredibly easy to mistake someone on the ground level as an economic buyer. How do you ensure this does not happen?

- Managers should provide a checklist of attributes of an economic buyer and in the pipeline review, it is just a matter of ensuring that every check box is ticked by the sales rep. Are they signing the contract? Do they have veto power? Are they focused on the strategy side of things? Do they control the budget?

- Middle:

- As the quarter progresses, you should move on to explaining how your value proposition compares to others. You want to convey what value you provide to their business. Unlike some other stakeholders, you should be talking about how your product helps them to achieve their long-term goals. It is essential you are really convincing at this stage. You want them out of all people to believe in your product.

- Managers should be asking every sales rep if their value proposition is tailored to the prospects’ pain points.

- End:

- At the end of the quarter, you need to provide evidence. This means case studies and stats to show how your proposition has provided value to others.

- Reps need to find the best use case for each prospect. One way to make this easier is to drop all your use-cases into a spreadsheet so you can easily identify which use-cause is the most suitable. Then, in pipeline reviews managers can ask reps to explain why they have chosen each use-case.

DECISION CRITERIA

The decision criteria are the guidelines used by organizations to make a decision.

There are three different types of decision criteria:

- Technical – is your solution compatible with theirs?

- Economic – is your solution viable from a finance, risk, and efficiency perspective?

- Relationship – do your values align?

You need to identify if the prospect has a decision criteria early on to ensure you tailor their journey to it.

How to crack the decision criteria in your pipeline reviews

When conducting your pipeline review, managers can go through each of the different types of criteria with their sales reps.

For example, when a sales rep is looking at technical – you would be interested in talking to the CTO whereas, a CFO would be more interested in the economics.

Here is how to approach the decision criteria in your pipeline reviews:

- Start:

- At the start of the quarter, the focus should be on identifying if the prospect has a decision criteria and what it is.

- Managers should outline a plan for reps to leverage and ensure they align with the prospects’ criteria. For example, if one of the criteria set is a return on investment then an action point on the plan would be to create a timeline showing how long it would take to make a return on investment for the prospect.

- Middle:

- As the quarter progresses, you need to check whether all stakeholders are aware of the decision criteria and how your business provides a unique solution for it.

- Now you have an action plan, this stage is all about ticking boxes. Managers can go through what has been completed and what needs to be done. Then, push sales reps to cover the incomplete decision criteria action points.

- End:

- At the end of the quarter, do you have a consensus that you solve the decision criteria better than anyone else?

- Ideally, you would want to see all of the action points completed at that stage. Managers should be going through every stakeholder involved and understanding if they feel you have met their criteria.

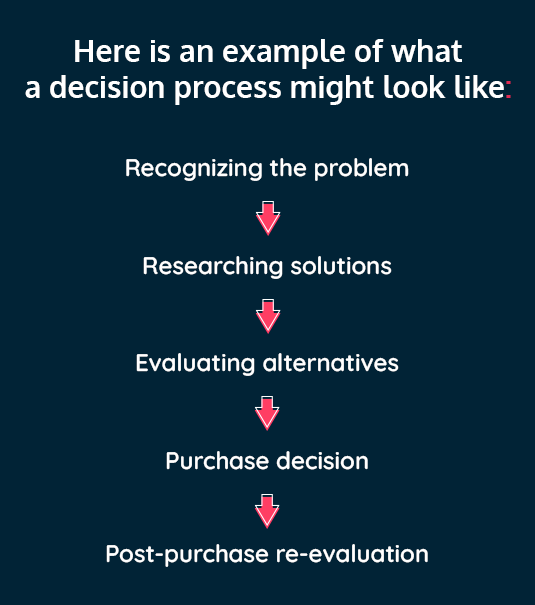

DECISION PROCESS

These are the steps a buyer will follow leading to a decision.

This answers how the decision will be made. Whereas, decision criteria looks at what the decision will be based on.

How to approach the decision process in your pipeline review

People often confuse high activity with stakeholders as making progress.

Booking more calls, meetings and sending more emails will not improve the chances of closing the deal.

Strong engagement with key stakeholders delivers win rates of 59%, compared to only 25% with good engagement. As a result, ensuring engagement remains strong throughout the sales process drastically increases the odds of success

Here is how to approach the decision process in your pipeline reviews:

- Start:

- At the start of the quarter, managers need to dive into how their prospects will make a decision.

- Take the time to understand what each step of the process looks like and get this on paper so there is visibility across your team. You should also assign tasks for each step. For example, if your prospect is evaluating alternatives, ask sales reps to prepare a deck on why your solution provides more value than competitors.

- Middle:

- As the quarter progresses, you should be fully aware of how the decision is going to be made and track each of those steps before the decision is made to stay on track.

- Now it is just a case of holding your sales reps accountable to hitting those task deadlines to ensure your prospect keeps moving through their decision process faster.

- End:

- At the end of the quarter, you should be seeing a lot of tick boxes on those steps and in the process of finalizing the last step.

PAPER PROCESS

This step is pretty straightforward.

You need to get through all the red tape to ensure your deal is able to close.

This step can radically improve the length of your sales cycle.

An example of a paper process is getting through legal and security teams. These teams should also be considered key stakeholders.

By staying on top of this and your champion, you can encourage these teams to begin evaluating the paperwork associated with your solution early. How?

By engaging with these teams early on.

You should be generating a rapport there so that when the time comes, you can smoothly close the deal.

How do you discuss the paper process in your pipeline reviews?

- Start:

- Sales reps need to identify what the red tape is going to look like.

- Middle:

- This is where you start to begin to build those relationships. Managers should be measuring engagement with these stakeholders to ensure that levels of engagement from their sales reps are high.

- End:

- If engagement is low, especially towards the end of the quarter, this could hinder the deal from progressing to a close. As we mentioned earlier, strong engagement with an opportunity delivered a win rate of 59%. Managers should be prioritizing engagement with those stakeholders to accelerate the deal to a close.

IMPLICATE PAIN

Pain is the problem your customer is facing that your business provides a solution for.

‘The higher the pain, the higher the value, the higher the priority.’ – MEDDPICC®

Implement MEDDPICC® today and empower your sales team today.

Download the guideThere are three types of pain:

- Financial pain

- Efficiency pain

- People pain

How to implicate pain in your pipeline review:

Identifying pain is just the beginning. So, what are the next steps?

Here is how to implicate pain in your pipeline reviews:

- Start:

- At the start of the quarter, you need to identify the pain in discovery. After all, no pain, no gain.

- One way managers can stay on top of this is by looking at similar deals they have previously won and recapping their pain points. You can quickly see which companies have similar pain points and then extract learnings that can be leveraged in the next stages.

- Middle:

- As the quarter progresses, you have to indicate the cost of the pain to your customer. Revisit metrics at this stage to find this value.

- Sales reps should be aggravating and highlighting the cost of the pain during this time. Managers need to be reinforcing this to all their sales reps at this stage.

- End:

- At the end of the quarter, you need to implicate the pain. The customer needs to feel the negative impact it is having on their business.

- You have already compiled a list of all the possible pain points your solution covers and now you can easily match your prospects’ pain points with an existing customer case study.

CHAMPION

A champion is someone who has a vested interest in the success of your product.

If the product performs well, you both win.

If not, you both lose.

They act as an internal seller on your behalf and usually have influence and power over business decisions.

Therefore, no champion, no deal.

You want the champion on your side. But how do you do this?

By building a strong relationship and keeping them highly engaged.

This person is going to tell their peers and economic buyers about how much they need your product.

Keeping them well engaged amplifies the conversations they are having within their organization and increases your chances of closing the deal successfully.

How to discuss your champion in your pipeline reviews

Now, this is someone who you really want to have high engagement with.

Trust is an extremely important aspect of building a champion and trust takes time and consistency.

Here is how to build your champion in your pipeline reviews:

- Start:

- At the start of the quarter, your sales rep needs to identify the champion and test the champion to ensure they are qualified to provide you with the information you need. Do they have power? Do they act as an internal seller for you? Do they have a vested interest in your business?

- A champion is not a champion until you have ALL the evidence to prove otherwise. At this stage, sales reps should be nailing down who the champion could be. You should prepare a checklist of all the above questions to make sure you have the right person. Then in pipeline reviews, it will assure sales managers that you do in fact have the right person.

- Middle:

- As the quarter progresses, you need to revisit the metrics section of MEDDPICC® and get the answers for the three metrics questions from the champions’ perspective. On top of this, you should assess if they have been introduced to all the relevant stakeholders needed to secure the deal.

- It is vital that managers stay on top of their sales reps at this stage as there are several components at play. Managers should be asking their sales reps; how the champion addresses the three metrics questions, has the champion introduced you to all the relevant stakeholders and how is engagement trending with the champion.

- End:

- At the end of the quarter, it comes back to engagement again. How engaged are you with all of the relevant stakeholders? You want to ensure you have built solid relationships with all of these stakeholders, particularly in the later stages of a deal.

- Now managers will be assessing engagement with the champion and all the stakeholders. Weak engagement decreases the chances of closing the deal successfully, and therefore the priority should be to maintain engagement.

COMPETITION

Looking at competitors tells you where you might need collateral/resources to keep your product as the favorite.

If there are competitors, you will need comparable collateral to show how you are different.

If it’s competing resources, then sales teams need collateral which demonstrates the business impact your product delivers.

A common mistake made by sales teams is only considering competition as those with rival solutions.

However, competition could be anyone competing for the same funds or resources as you.

How to cover competition in your pipeline review

Your competitive strategy should enable you to be one step ahead of your competition.

Here is how to tackle competition in your pipeline reviews:

- Start:

- At the start of the quarter, you need to identify whether there is competition and if so who the competition is.

- Managers should be asking what the sales reps’ plans are to highlight how your solution differs from the competitors and how your solution provides additional value. This should be used to hold sales reps accountable throughout the quarter.

- Middle:

- As the quarter progresses, you should focus on your competitive strategy.

- Managers will be asking sales reps the following questions: Are there any stakeholders who favor the competition? How are you communicating the unique value of your solution? Are there any technical difficulties you need to overcome? Are you on track with their competitive plan?

- End:

- At the end of the quarter, you should be asking if a majority of the stakeholders believe that your solution is superior.

- Managers should now be asking if your solution is preferred over the competition? At this stage, the answer should be yes.

The 8 MEDDPICC® factors are key in determining success so it is essential to include them in your pipeline reviews.

We can make the implementation of MEDDPICC® easier. How?

MEDDPICC® is simple when all the information you need is in one place making it easy to refer back to.

This creates more visibility of your pipeline.

We can do the heavy lifting for you with our revenue intelligence platform.

Conclusion

The MEDDPICC® framework helps to qualify the right leads.

Get your own copy of how to implement MEDDPICC® framework.

Download the guideHelps both buyer and seller to navigate through the sales process smoothly.

It also drives consistency so both managers and reps know what to expect in their pipeline reviews. Focusing on 8 specific points.

It provides sales managers with better pipeline visibility so they can give more specific actionable feedback to their reps. It also allows them to make better decisions.

MEDDPICC® can shorten sales cycles, improve win rates and so much more.

MEDDPICC® is a registered trademark of Darius Lahoutifard, exclusively licensed by MEDDIC Academy, and is being used with permission.