Table of Contents

Share this article

Learn from the brightest minds how to predictably and efficiently grow revenue.

Related Content

Why the Return to Full-Cycle Sales Matters: A Lot

Our 2025 GTM Benchmarks Report found that 46% of SaaS and tech companies are returning to a full-cycle sales model, where one seller manages the entire customer journey, from prospecting and closing to post-sale nurturing. While this stat raised eyebrows, it also prompted some skeptics to ask: “So what?” Isn’t this just another sales strategy…

How Top Performers Handle Objections 80% Earlier, with Hervé Timsit from EDB

In this episode of Revenue Insights, host Guy Rubin, CEO of Ebsta, sits down with Hervé Timsit, Chief Revenue Officer at EDB, to explore objection handling and the evolving landscape of enterprise software sales. With over 17 years of experience, Hervé shares insights on leading global sales teams, implementing data-driven strategies, and the critical role…

Why Value Alignment is the New Growth Engine, with Dan Sylvester from SundaySky

In this episode of Revenue Insights, host Adam Roberts, Sales Director at Ebsta, sits down with Dan Sylvester, SVP of Revenue at SundaySky to explore value alignment and the evolution of B2B sales and customer success. Dan shares insights on the growing importance of personalized video content, maintaining brand consistency while democratizing content creation, and…

B2B Sales Benchmarks: 2023 H1 Update

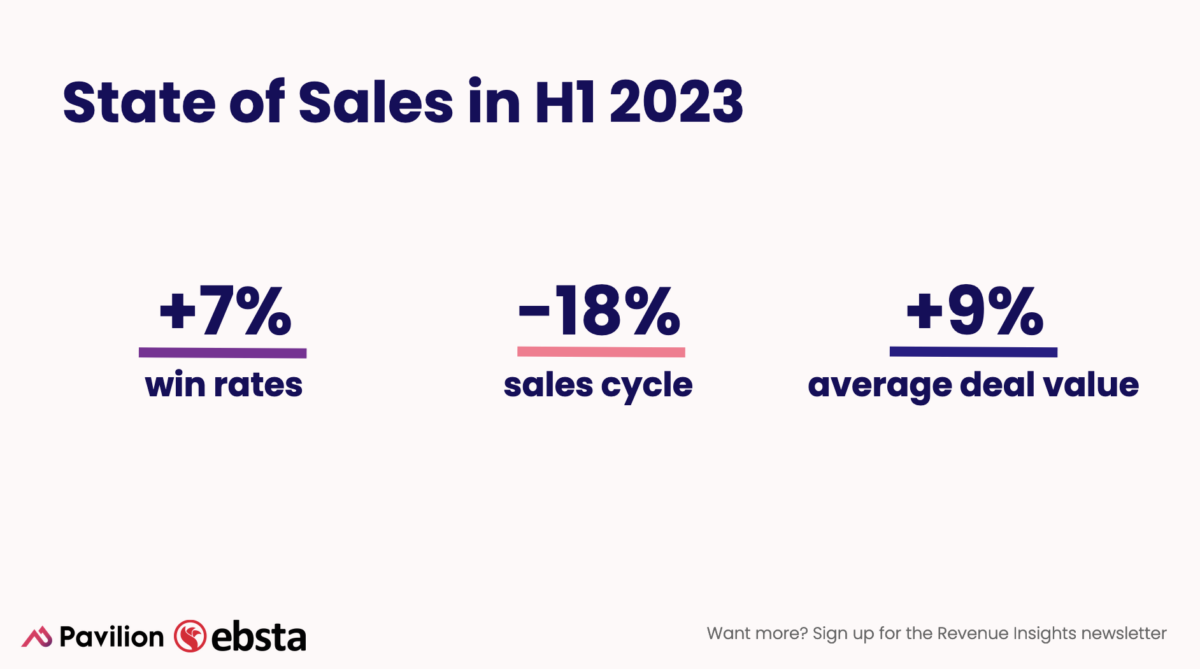

When we analyzed $37bn worth of sales pipeline at the beginning of 2023 with Pavilion, the state of the market was clear; win rates were down (-15%), sales cycles were growing (+32%) and deal values were shrinking (-32%).

But market conditions can change quickly. By June 2023, win rates had risen by 7%, sales cycles were 18% shorter, and deal values grew by 9%.

On the surface, it’s a positive picture.

It suggests that many businesses have endured the turbulence of the second half of 2022, and buyer confidence is increasing again.

However, when we investigate further, there’s more to the story than these lagging indicators.

Table of Contents

State of sales in H1 2023

For this H1 2023 update to the B2B Sales Benchmarks, our analysis looks at three key challenges facing sales teams; quota attainment, deal slippage, and consistent AE improvement.

Compared to the end of 2022, rep quota attainment has fallen (-7%), while deal slippage has grown (+7%).

Given the state of sales – these figures are surprising. Despite the average sales velocity improving in the last 6 months, we should expect this market improvement to be visible elsewhere.

However, while market conditions may have improved, it’s evident that top performers are reaping the rewards of a stable market, while consistent improvement continues to elude middle and low performers,

Why are more than 70% of sellers falling short?

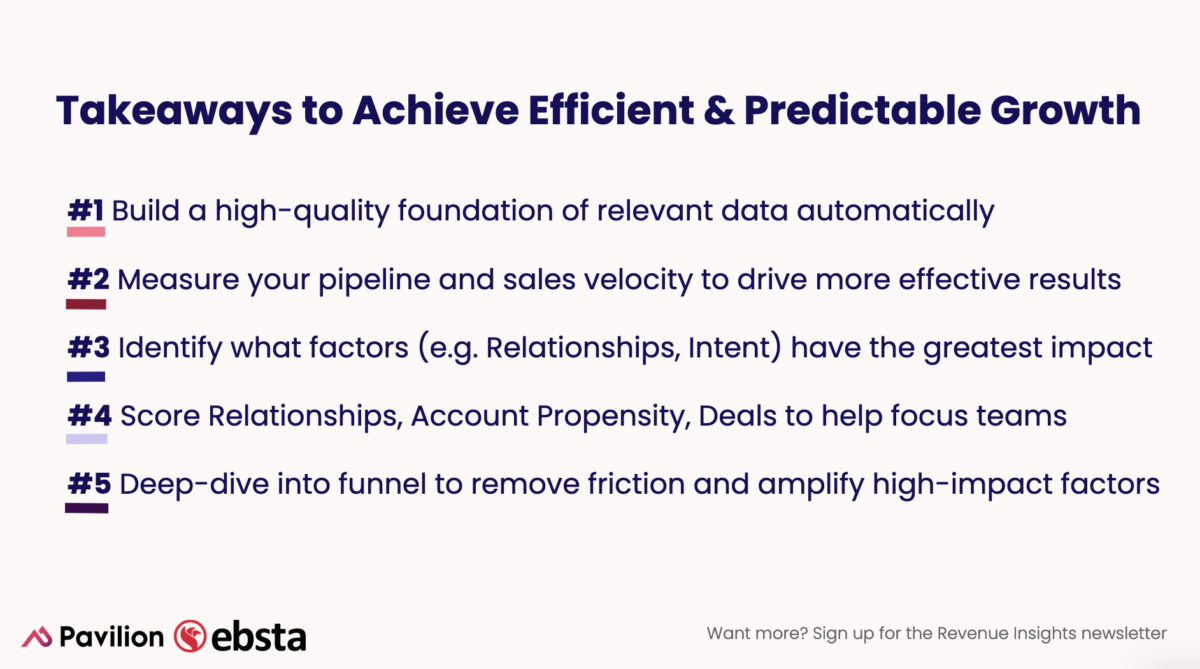

To understand this question, we focused our analysis on the factors driving business success in the first half of 2023.

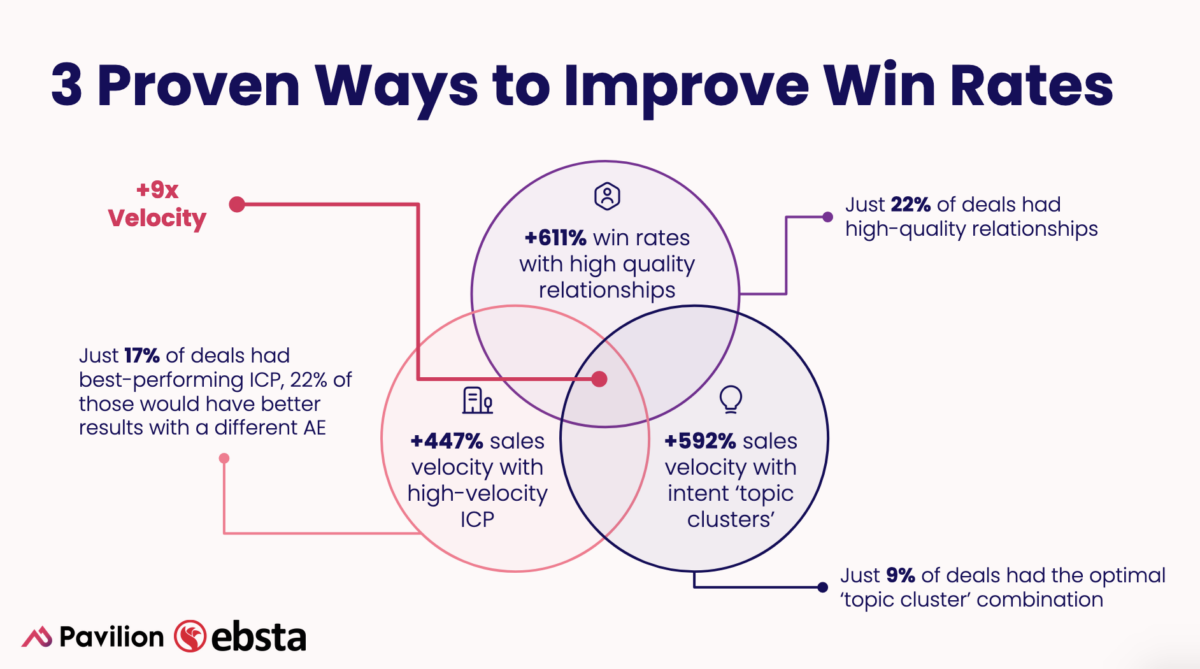

The three most common factors related to what accounts sellers are targeting, the intent of those accounts, and the quality of the relationships they have with the buying committee.

As we will discover later, what separates high-performing reps from the rest of their peers is not that they work harder. Instead, they are working smarter.

For example, your product will be a better fit for some ICPs than others, and a seller’s skillset and network will be better suited to a specific ICP. Despite this, only 17% of deals met the reps’ highest velocity ICP – meaning many sellers’ time could be spent more efficiently on deals they are more likely to close.

Similarly, strong relationships are a well-known component of successful deals. However, only 22% of opportunities had high-quality relationships associated with them. As we will explore later, for high-performers, it’s not only about having the right relationships with the right buyer – it’s having a strong relationship with key individuals at a target account.

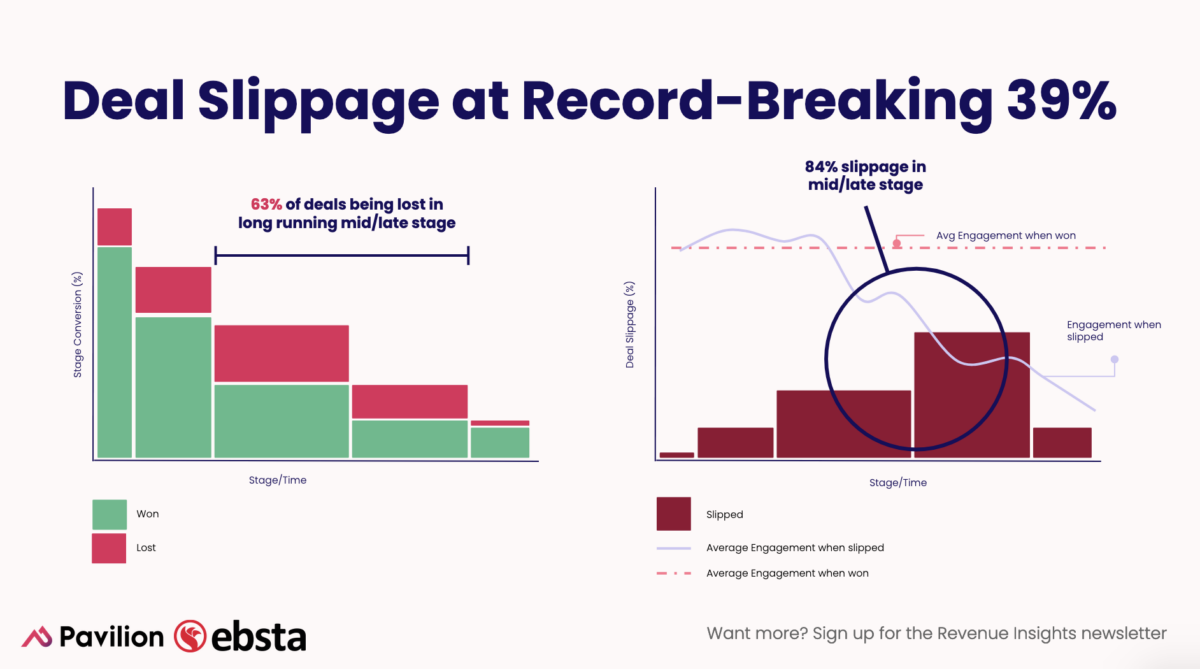

Why are 39% of deals slipping?

Deal slippage has long been a thorn in the side of many businesses. We’ve all been there, with quotas hanging on a few large deals. Then, unexpectedly, the champion leaves the business, budgets are deployed elsewhere, or a competitor is chosen instead.

When a deal slips, targets are missed, forecasts are wrong, and frustration is widespread across the business. It’s a familiar story that, according to our analysis, is all too common:

Deal slippage commonly happens at the mid/late stage, often due to optimistic (sometimes overly) sellers who are convinced of an opportunity’s success.

However, deal slippage is not a certainty. While many factors can cause a deal to slip, having analyzed over three million opportunities, some aspects are more common than most.

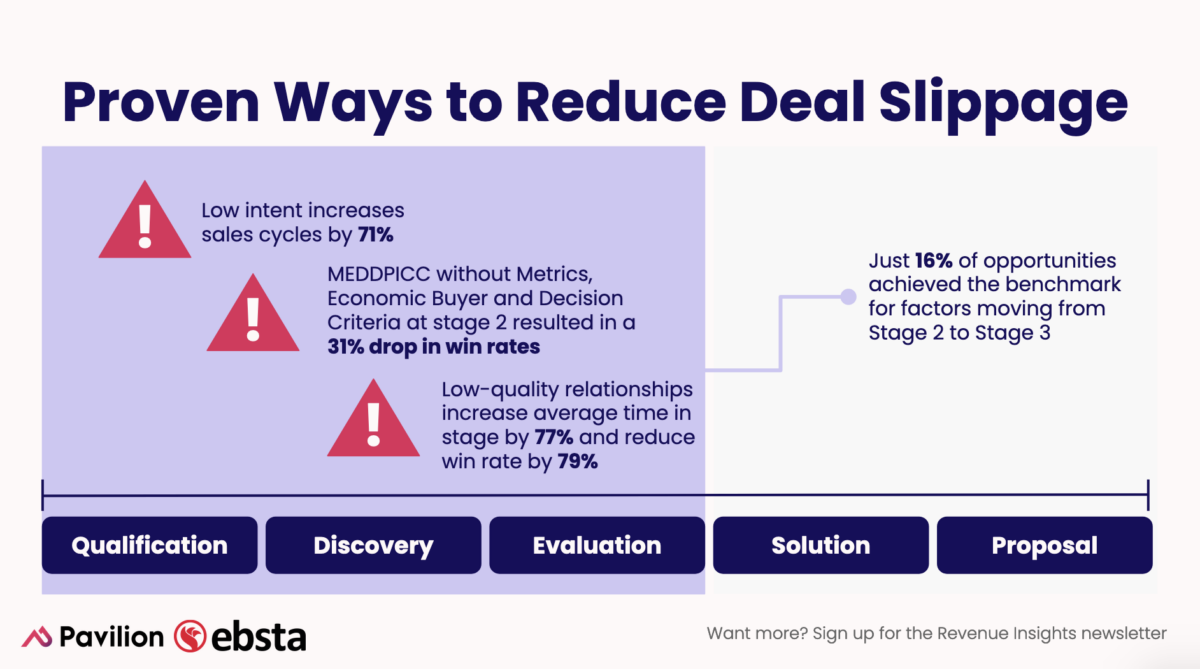

Low-intent prospects, unqualified deals, and single-threaded deals are all telltale signs that a deal will likely slip.

What’s worse is that only 16% of deals achieved the benchmark of these factors to move from stage 2 into stage 3.

Deal slippage may feel inevitable, but there’s evidence that far too many low-quality opportunities are entering sellers’ pipelines.

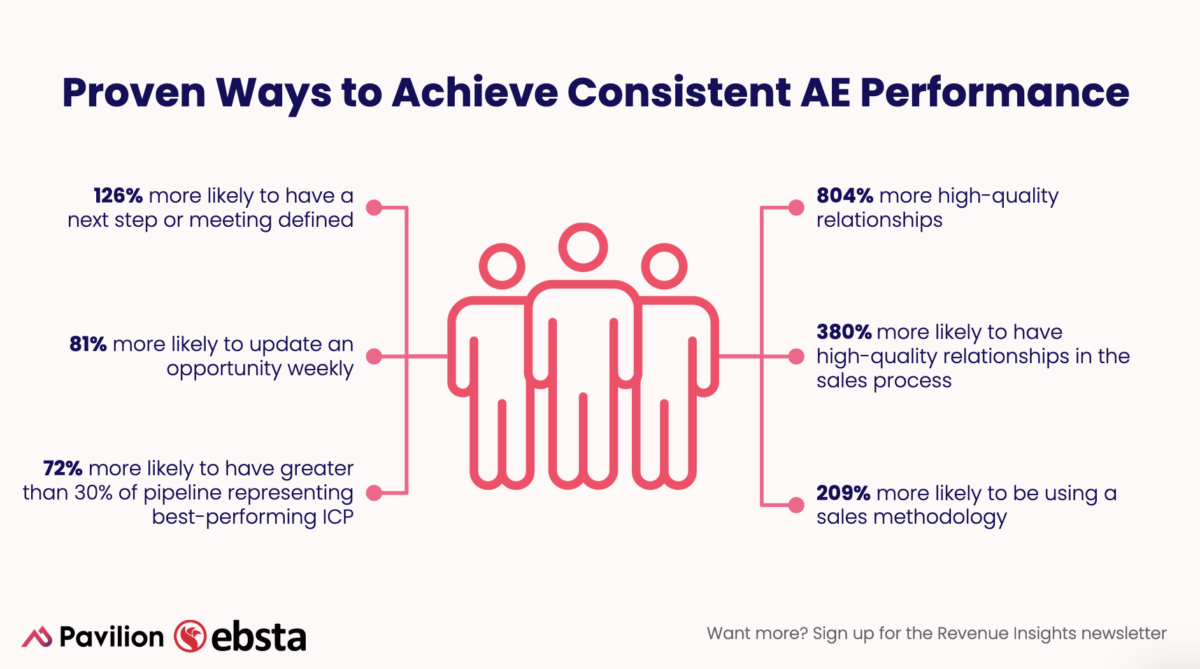

How high-performers consistently exceed their targets

23% of sellers are contributing 83% of revenue. It’s a stark stat that shows how many sellers consistently miss their quota.

In a buoyant market, the typical strategy is to churn through sellers to strike gold and add another high-performer to their team.

However, despite market conditions improving, we remain in a bear market. AE hiring has slowed by 65%, and sales teams are 22% smaller.

The answer is no longer more, more, more. Instead, we keep hearing, ‘How do we generate more with less?’

The answer lies in the behavior of the 23% who are succeeding.

The secret behind high-performance sales, according to our analysis, is simple. It relies on the effective execution of foundational sales. Build strong relationships with the right people, at the right accounts, at the right time.

This is only aided by the diligent use of a sales methodology and regularly updating deals. This enables them to receive effective coaching from their leaders and mentors.